Navigating the Los Angeles County Tax Assessor Map: A Comprehensive Guide

Related Articles: Navigating the Los Angeles County Tax Assessor Map: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Los Angeles County Tax Assessor Map: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Los Angeles County Tax Assessor Map: A Comprehensive Guide

The Los Angeles County Tax Assessor’s Office plays a vital role in the administration of property taxes, a cornerstone of local government funding. At the heart of this operation lies the Los Angeles County Tax Assessor Map, an invaluable tool for understanding property ownership, values, and tax information across the vast expanse of Los Angeles County. This comprehensive guide delves into the intricacies of this map, exploring its functionalities, benefits, and significance in the context of property ownership and taxation.

Understanding the Los Angeles County Tax Assessor Map

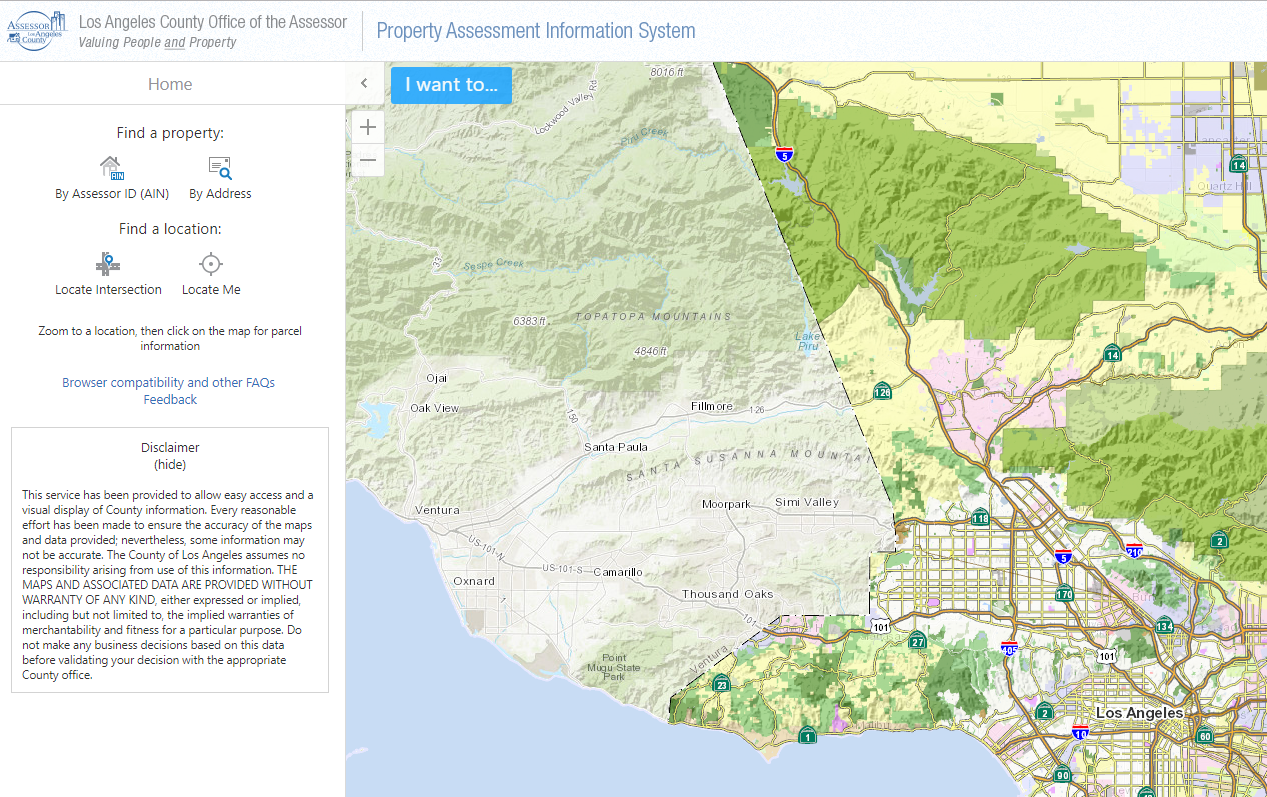

The Los Angeles County Tax Assessor Map is an interactive online platform that provides a visual representation of property boundaries, ownership information, and assessed values for every parcel of land within the county. This map serves as a central repository of crucial data, empowering individuals, businesses, and government agencies with essential insights into the property landscape of Los Angeles County.

Key Features and Functionalities

The Los Angeles County Tax Assessor Map boasts a user-friendly interface designed to cater to diverse needs, offering a range of features that enhance its utility:

-

Interactive Map Interface: The map utilizes a dynamic and intuitive interface, allowing users to zoom in and out, pan across the county, and pinpoint specific locations with ease.

-

Property Search Capabilities: Users can search for properties by address, parcel number, owner name, or legal description, providing a streamlined method for identifying and accessing information about a particular property.

-

Property Details: Once a property is located, users can access detailed information, including:

- Parcel Number: A unique identifier assigned to each property.

- Legal Description: A precise description of the property’s boundaries.

- Owner Name: The legal owner of the property.

- Assessed Value: The estimated market value of the property for tax purposes.

- Property Characteristics: Information about the property’s size, zoning, and improvements.

- Tax Information: Details about the property’s tax bill, including the assessed value, tax rate, and payment history.

-

Aerial Imagery: High-resolution aerial imagery offers a visual representation of the property, providing context and aiding in property identification.

-

Neighborhood Analysis: The map allows users to explore property data within specific neighborhoods, enabling comparative analysis of property values and tax burdens across different areas.

-

Property History: Users can access historical property data, including past ownership information, assessed values, and tax records, providing a comprehensive overview of a property’s history.

Benefits of Utilizing the Los Angeles County Tax Assessor Map

The Los Angeles County Tax Assessor Map offers numerous benefits for a wide range of stakeholders:

-

Property Owners: The map empowers property owners with access to crucial information about their property, including its assessed value, tax obligations, and ownership history. This information can be instrumental in making informed decisions regarding property management, financing, and potential sales.

-

Real Estate Professionals: Real estate agents, appraisers, and investors leverage the map to gather vital property data, conduct market research, and analyze property values, facilitating informed decision-making in real estate transactions.

-

Government Agencies: The map serves as a valuable resource for government agencies, enabling them to effectively manage property taxes, assess property values for development projects, and monitor land use patterns.

-

Community Members: The map empowers community members to access information about property ownership, tax burdens, and development projects within their neighborhoods, fostering transparency and facilitating community engagement in local issues.

Navigating the Map Effectively: A Step-by-Step Guide

To maximize the benefits of the Los Angeles County Tax Assessor Map, follow these simple steps:

-

Access the Map: Visit the Los Angeles County Tax Assessor website and navigate to the interactive map section.

-

Select a Search Method: Choose from the available search options, such as address, parcel number, owner name, or legal description.

-

Enter Search Criteria: Enter the relevant information for your search query.

-

View Property Details: Once the property is located, click on the property marker to access detailed information.

-

Utilize Additional Features: Explore the map’s functionalities, including zoom, pan, aerial imagery, and neighborhood analysis, to gain a comprehensive understanding of the property and its surroundings.

Frequently Asked Questions (FAQs)

Q: How can I obtain a copy of my property tax bill?

A: The Los Angeles County Tax Assessor’s Office provides online access to property tax bills. You can access your bill by entering your property address, parcel number, or owner name.

Q: How is the assessed value of my property determined?

A: The assessed value of your property is determined by the Los Angeles County Assessor’s Office based on a variety of factors, including market value, property characteristics, and recent sales data.

Q: What are the deadlines for paying property taxes?

A: Property taxes are due on the first Tuesday of February and the first Tuesday of November.

Q: How can I appeal my property’s assessed value?

A: If you believe that your property’s assessed value is inaccurate, you can file an appeal with the Los Angeles County Assessor’s Office.

Q: What are the resources available for property owners seeking assistance with tax issues?

A: The Los Angeles County Tax Assessor’s Office offers a variety of resources for property owners, including online guides, FAQs, and contact information for staff who can answer questions and provide assistance.

Tips for Maximizing the Use of the Los Angeles County Tax Assessor Map

-

Utilize the Map Regularly: Regularly accessing the map can provide valuable insights into property trends, market fluctuations, and neighborhood developments.

-

Save Search Results: Save frequently used search results for easy access to specific properties or areas of interest.

-

Explore Additional Features: Take advantage of the map’s advanced functionalities, such as neighborhood analysis and property history, to gain a deeper understanding of property data.

-

Contact the Assessor’s Office: If you have any questions or require assistance, contact the Los Angeles County Tax Assessor’s Office for personalized support.

Conclusion

The Los Angeles County Tax Assessor Map serves as a vital resource for understanding property ownership, values, and tax information within the county. Its user-friendly interface, comprehensive data, and powerful functionalities empower individuals, businesses, and government agencies with valuable insights into the property landscape of Los Angeles County. By utilizing this map effectively, stakeholders can navigate the complexities of property ownership, make informed decisions, and contribute to the efficient and equitable administration of property taxes in Los Angeles County.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Los Angeles County Tax Assessor Map: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!