Understanding the S&P 500: A Comprehensive Guide to a Key Market Indicator

Related Articles: Understanding the S&P 500: A Comprehensive Guide to a Key Market Indicator

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the S&P 500: A Comprehensive Guide to a Key Market Indicator. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding the S&P 500: A Comprehensive Guide to a Key Market Indicator

- 2 Introduction

- 3 Understanding the S&P 500: A Comprehensive Guide to a Key Market Indicator

- 3.1 The Composition of the S&P 500

- 3.2 The Importance of the S&P 500

- 3.3 Understanding S&P 500 Data and Charts

- 3.4 Using the S&P 500 for Investment Decisions

- 3.5 Factors Influencing the S&P 500

- 3.6 FAQs About the S&P 500

- 3.7 Tips for Using the S&P 500 for Investment Decisions

- 3.8 Conclusion

- 4 Closure

Understanding the S&P 500: A Comprehensive Guide to a Key Market Indicator

The S&P 500, or Standard & Poor’s 500, is a widely recognized stock market index that tracks the performance of 500 large-cap U.S. companies. It serves as a benchmark for the overall health and direction of the American stock market, offering investors a valuable tool for understanding market trends and making informed investment decisions.

The Composition of the S&P 500

The S&P 500 index is carefully constructed to represent a broad cross-section of the U.S. economy. It includes companies from various sectors, including:

- Information Technology: This sector comprises companies involved in software, hardware, semiconductors, and internet services.

- Health Care: This sector encompasses pharmaceutical companies, medical device manufacturers, healthcare providers, and biotechnology firms.

- Financials: This sector includes banks, insurance companies, investment firms, and real estate investment trusts.

- Consumer Discretionary: This sector comprises companies that sell non-essential goods and services, such as automobiles, apparel, restaurants, and travel.

- Industrials: This sector includes companies involved in manufacturing, transportation, construction, and industrial equipment.

- Consumer Staples: This sector comprises companies that sell essential goods and services, such as food, beverages, and personal care products.

- Energy: This sector includes companies involved in oil and gas exploration, production, refining, and distribution.

- Materials: This sector includes companies involved in mining, chemicals, and metals.

- Utilities: This sector comprises companies that provide electricity, gas, and water services.

- Real Estate: This sector includes companies involved in real estate development, management, and investment.

The index is market-capitalization weighted, meaning that companies with larger market capitalizations have a greater influence on the index’s overall performance. This weighting system ensures that the index reflects the relative importance of each company within the U.S. economy.

The Importance of the S&P 500

The S&P 500 holds significant importance in the financial world for several reasons:

- Benchmark for Market Performance: It serves as a primary gauge of the overall health and direction of the U.S. stock market. Investors and analysts use it to track market trends, identify opportunities, and assess the performance of their portfolios.

- Investment Tool: Many investors use the S&P 500 as a benchmark for their investment strategies. They may choose to invest in index funds or exchange-traded funds (ETFs) that track the S&P 500, aiming to achieve a similar return as the broader market.

- Economic Indicator: The S&P 500’s performance is often seen as a reflection of the overall health of the U.S. economy. Its fluctuations can provide insights into economic growth, inflation, and consumer confidence.

- Indicator of Investor Sentiment: The S&P 500’s performance can also reflect investor sentiment. A rising index suggests optimism and confidence in the economy, while a declining index indicates pessimism and uncertainty.

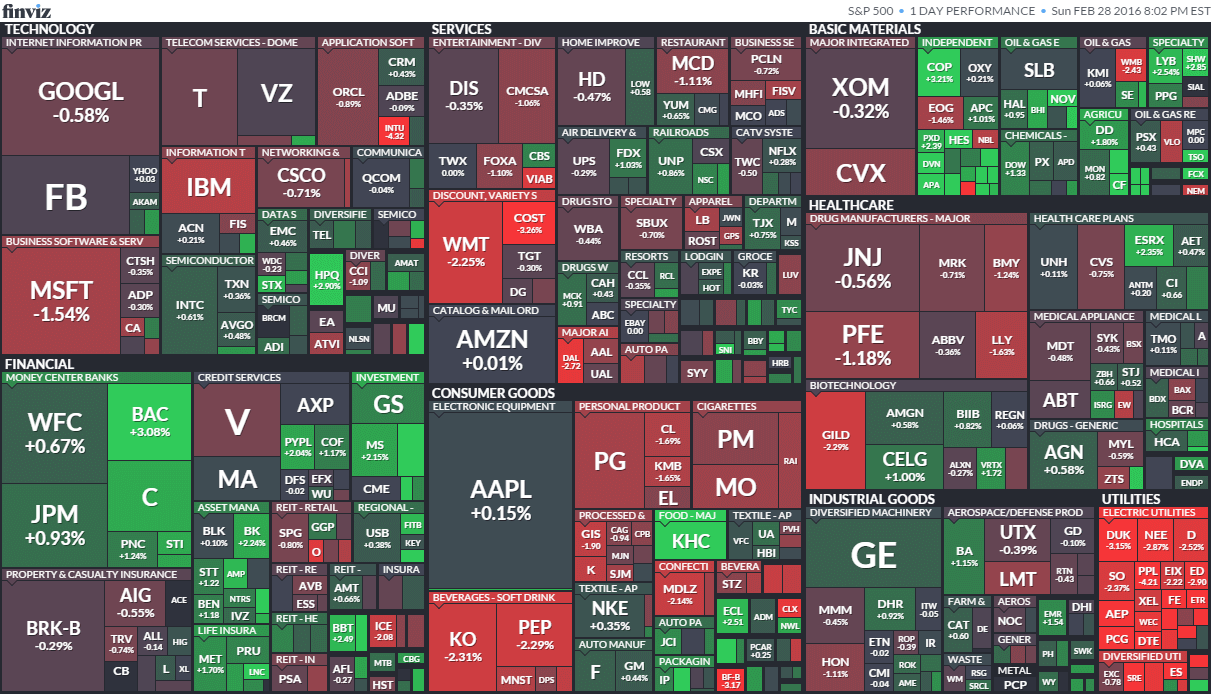

Understanding S&P 500 Data and Charts

The S&P 500 index is represented by a numerical value that reflects the combined performance of its constituent companies. This value is constantly changing, influenced by factors such as company earnings, economic news, and investor sentiment.

Data and Charts:

- Historical Data: Historical data on the S&P 500 can be accessed through various financial websites and data providers. This data allows investors to analyze long-term trends, identify market cycles, and assess the index’s performance over different periods.

- Real-Time Data: Real-time data on the S&P 500 is available through financial news websites, brokerage platforms, and financial data providers. This data provides investors with up-to-the-minute information on the index’s performance.

- Charts: Charts are a powerful tool for visualizing the S&P 500’s performance over time. Line charts, bar charts, and candlestick charts are commonly used to depict the index’s movements, highlighting trends, patterns, and volatility.

Using the S&P 500 for Investment Decisions

The S&P 500 can be a valuable tool for investors seeking to make informed decisions. Here’s how it can be used:

- Market Timing: By analyzing the S&P 500’s performance, investors can gain insights into market trends and potentially identify favorable entry and exit points for their investments.

- Diversification: Investing in index funds or ETFs that track the S&P 500 provides investors with a diversified portfolio, spreading risk across a broad range of companies.

- Long-Term Growth: The S&P 500 has historically delivered positive returns over the long term. Investors seeking to grow their wealth over time may consider investing in the index.

Factors Influencing the S&P 500

Numerous factors can influence the S&P 500’s performance, including:

- Economic Growth: Strong economic growth typically leads to increased corporate profits, which can drive the S&P 500 higher.

- Interest Rates: Rising interest rates can make borrowing more expensive for companies, potentially impacting their profitability and slowing economic growth.

- Inflation: High inflation can erode corporate profits and lead to higher borrowing costs, potentially weighing on the S&P 500.

- Geopolitical Events: Global events such as wars, trade disputes, and political instability can create uncertainty and volatility in the market.

- Company Earnings: Strong corporate earnings reports can boost investor confidence and drive the S&P 500 higher.

- Consumer Sentiment: Consumer spending is a significant driver of economic growth. High consumer confidence can lead to increased spending, benefiting companies and supporting the S&P 500.

FAQs About the S&P 500

1. How is the S&P 500 Calculated?

The S&P 500 is calculated using a market-capitalization weighted method. Each company’s weight in the index is determined by its market capitalization, which is calculated by multiplying the company’s share price by the number of outstanding shares.

2. What is the Relationship Between the S&P 500 and the Economy?

The S&P 500 is often viewed as a barometer of the U.S. economy. A rising index suggests strong economic growth, while a declining index indicates potential economic weakness.

3. What are the Benefits of Investing in the S&P 500?

Investing in the S&P 500 offers several benefits, including:

- Diversification: Investing in an index fund or ETF that tracks the S&P 500 provides investors with a diversified portfolio, reducing risk.

- Long-Term Growth: The S&P 500 has historically delivered positive returns over the long term, providing investors with the potential for growth.

- Ease of Investment: Index funds and ETFs that track the S&P 500 are readily available and easy to invest in.

4. What are the Risks Associated with Investing in the S&P 500?

Like any investment, investing in the S&P 500 carries risks, including:

- Market Volatility: The stock market is inherently volatile, and the S&P 500 can experience fluctuations in value.

- Economic Downturns: Economic downturns can lead to decreased corporate profits and a decline in the S&P 500.

- Inflation: High inflation can erode the value of investments, including the S&P 500.

5. How Can I Invest in the S&P 500?

Investors can invest in the S&P 500 through:

- Index Funds: These funds track the performance of the S&P 500, providing investors with a low-cost and diversified way to invest in the index.

- Exchange-Traded Funds (ETFs): These funds are similar to index funds but are traded on stock exchanges, offering investors greater flexibility and potential for intraday trading.

Tips for Using the S&P 500 for Investment Decisions

- Consider Your Investment Goals: Before investing in the S&P 500, it’s crucial to define your investment goals, risk tolerance, and time horizon.

- Do Your Research: Thoroughly research the S&P 500, its history, and the factors that influence its performance.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Diversify your portfolio by investing in other asset classes, such as bonds, real estate, or commodities.

- Consider Long-Term Investments: The S&P 500 has historically delivered positive returns over the long term. Consider investing for the long term, allowing time for market fluctuations to smooth out.

- Seek Professional Advice: If you’re unsure about how to invest in the S&P 500, consult with a financial advisor who can provide personalized guidance based on your specific needs and circumstances.

Conclusion

The S&P 500 is a powerful tool for understanding the U.S. stock market and making informed investment decisions. By understanding its composition, importance, and factors influencing its performance, investors can gain valuable insights into market trends and potentially achieve their investment goals. It’s essential to remember that the S&P 500 is not a foolproof investment strategy and carries risks. However, with proper research, diversification, and a long-term perspective, it can be a valuable addition to any investment portfolio.

:max_bytes(150000):strip_icc()/weighting-of-SP-64bd20169a194e8f91a0499a1ecd4705.jpg)

Closure

Thus, we hope this article has provided valuable insights into Understanding the S&P 500: A Comprehensive Guide to a Key Market Indicator. We appreciate your attention to our article. See you in our next article!